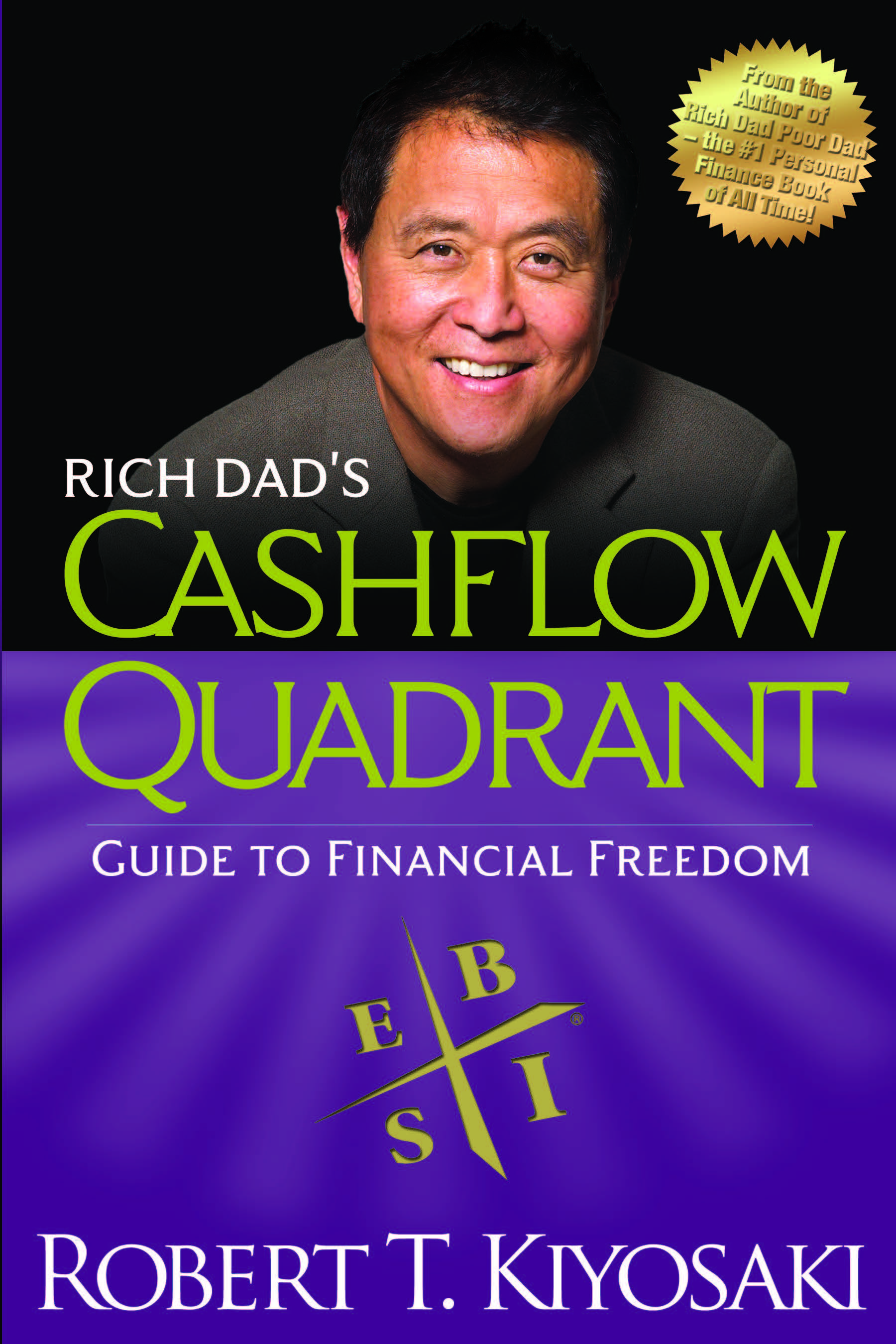

Rich Dad Author Robert Kiyosaki’s Cashflow Quadrant teaches not just the difference between being an employee and an investor but the two other important transitional quadrants in between.

Born and raised in Hawaii, Robert T. Kiyosaki co-founded an international education company that operated in seven countries, teaching business to tens of thousands of graduates. Now retired, Robert does what he enjoys most…investing. Concerned about the growing gap between the haves and have nots, Robert created the board game CASHFLOW, which teaches the game of money, here before only known by the rich.

Sharon L. Lechter is a wife and mother of three, CPA, consultant to the toy and publishing industries and business owner. As co-oauthor of RICH DAD, POOR DAD and THE CASHFLOW QUADRANT, she now focuses her efforts in helping to create educational tools for anyone interested in bettering their own financial education.

Understanding Rich Dad’s Cashflow Quadrant

The Cashflow Quadrant is a powerful tool for understanding the different ways people earn income and build wealth. Developed by Robert T. Kiyosaki, the concept categorizes individuals into four distinct quadrants: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I).

Each quadrant represents a unique approach to generating income and attaining financial freedom.

By understanding the Cashflow Quadrant, readers can gain a deeper understanding of their financial situation and make informed decisions about their financial future. Understanding how to manage cash flow is crucial for those looking to transition from the E and S quadrants to the B and I quadrants.

Whether you are an employee looking to transition to a business owner or an investor seeking to create passive income streams, the Cashflow Quadrant provides a roadmap to financial independence.

The Four Quadrants

The four quadrants of the Cash Flow Quadrant are:

- Employee (E): Individuals who work for others and earn a salary or wages. Employees trade their time for money and often have limited control over their income and job security.

- Self-Employed (S): Individuals who work for themselves and earn income from their own skills and expertise. Self-employed individuals have more control over their work but often face challenges in scaling their income without working longer hours.

- Business Owner (B): Individuals who own and operate businesses that generate income through systems and teams. Business owners leverage the efforts of others to create scalable income streams and generate significant business profits, offering greater potential for financial growth.

- Investor (I): Individuals who earn passive income through investments such as real estate, stocks, and bonds. Investors focus on building wealth by acquiring assets that generate income and capital gains without requiring active involvement.

Each quadrant has its own set of characteristics and opportunities for financial growth. Understanding the four quadrants can help you to identify your strengths and weaknesses and make informed decisions about your financial future.

Employee (E) and Self-Employed (S) Quadrants

The Employee (E) and Self-Employed (S) quadrants are often referred to as the “left side” of the Cashflow Quadrant. These quadrants are characterized by individuals trading their time for money, with limited financial freedom and scalability. Employees (E) work for others, exchanging their time and skills for a salary, while Self-Employed individuals (S) work for themselves, often as freelancers, consultants, or small business owners.

While the Self-Employed quadrant may offer more control and flexibility than the Employee quadrant, both quadrants share similar limitations. Income is directly tied to the individual’s time and effort, making it challenging to achieve significant wealth accumulation. Additionally, both quadrants often come with high tax rates, reducing the individual’s take-home pay.

To achieve financial independence, individuals in these quadrants must focus on increasing their income, reducing expenses, and building wealth-generating assets. However, this can be challenging, as their income is often limited by their time and skills.

Business Owner (B) and Investor (I) Quadrants

The Business Owner (B) and Investor (I) quadrants are often referred to as the “right side” of the Cashflow Quadrant. These quadrants are characterized by individuals generating passive income through assets and systems, with greater financial freedom and scalability.

Business Owners (B) build systems and hire people to work for them, leveraging other people’s time and skills to generate income. This allows for greater scalability and potential passive income. Investors (I) generate income through investments, such as real estate, stocks, and businesses, providing the potential for substantial passive income and financial freedom.

The Business Owner and Investor quadrants offer the greatest potential for achieving financial independence and wealth accumulation. By building assets and systems that generate passive income, individuals can reduce their reliance on active income and achieve greater financial freedom.

Achieving Financial Freedom through the Cashflow Quadrant

Achieving financial freedom requires a mindset shift and a willingness to take calculated risks. In the Employee quadrant, earning more money often requires working additional hours, which can limit financial growth.

By understanding the Cashflow Quadrant, you will be able to better identify opportunities to create passive income streams and build wealth.

The key to achieving financial freedom is to transition from the E and S quadrants to the B and I quadrants, where passive income streams can be generated. This requires a commitment to financial education, entrepreneurship, and investing.

By focusing on building businesses and acquiring income-generating assets, you can move towards financial independence and enjoy the benefits of passive income.

The Power of the Right Side of the Quadrant

The right side of the Cashflow Quadrant, comprising the Business Owner (B) and Investor (I) quadrants, holds the key to achieving financial independence and wealth accumulation. By generating passive income through assets and systems, individuals can reduce their reliance on active income and achieve greater financial freedom.

The power of the right side of the quadrant lies in its ability to provide scalability, flexibility, and financial freedom. Business Owners and Investors can earn money while they sleep, travel, or pursue other interests, allowing them to live a life of financial independence.

To achieve financial independence, individuals must focus on building assets and systems that generate passive income. This can be achieved through entrepreneurship, investing, and wealth-building strategies. By leveraging the power of the right side of the quadrant, individuals can achieve financial freedom and live a life of wealth and prosperity.

What’s it like on the right side of the quadrant?

Jeremy love’s to interview entrepreneurs who’ve made it to the right side and found Entrepreneurial Freedom! Check out some of his Freedom Interviews to see how folks have “made it”!

Transitioning to Financial Freedom

Transitioning to financial freedom requires a strategic plan and a willingness to take action.

You can start by developing specialized skills and building a side business while still employed. As the side business gains traction, you then transition to the S quadrant – self employment – and eventually to the B quadrant, where you can build a scalable business that generates passive income.

From there, you can transition to the I quadrant, where you can invest in assets that generate passive income. This journey involves continuous learning, adapting to new challenges, and staying committed to long-term financial goals.

Overcoming Obstacles to Financial Success

Achieving financial independence and wealth accumulation requires overcoming obstacles and challenges. Individuals must be willing to take risks, learn new skills, and adapt to changing circumstances.

One of the primary obstacles to financial success is the lack of financial education. Many individuals lack the knowledge and skills necessary to manage their finances effectively, leading to debt, financial stress, and limited wealth accumulation.

To overcome this obstacle, individuals must prioritize financial education and learning. This can be achieved through reading books, attending seminars, and seeking guidance from financial experts.

Another obstacle to financial success is the fear of failure. Many individuals are hesitant to take risks and pursue new opportunities due to fear of failure. However, failure is an essential part of the learning process, and it is often necessary to experience failure in order to achieve success.

To overcome the fear of failure, individuals must develop a growth mindset and be willing to take calculated risks. This can be achieved by setting clear goals, developing a plan, and seeking support from mentors and peers.

By overcoming obstacles and challenges, individuals can achieve financial independence and wealth accumulation. It requires dedication, hard work, and a willingness to learn and adapt. However, the rewards are well worth the effort, and individuals who achieve financial independence can live a life of wealth, prosperity, and financial freedom.

Strategies for Success

To achieve financial success through the Cashflow Quadrant, you can use the following strategies:

- Develop specialized skills and build a side business while still employed.

- Transition to the S quadrant and build a scalable business that generates passive income.

- Invest in assets that generate passive income, such as real estate, stocks, and bonds.

- Build multiple streams of income to reduce reliance on a single source of income.

- Continuously educate yourself on personal finance, entrepreneurship, and investing.

- Take calculated risks and be willing to adapt to changing circumstances.

By following these strategies and understanding the Cashflow Quadrant, individuals can achieve financial freedom and build wealth. The journey to financial success is a continuous process of learning, adapting, and taking action towards your financial goals.

About Cashflow Quadrant Author Robert Kiyosaki

Born and raised in Hawaii, Robert T. Kiyosaki co-founded an international education company that operated in seven countries, teaching business to tens of thousands of graduates.

Now retired, Robert does what he enjoys most…investing.

Concerned about the growing gap between the haves and have nots, Robert created the board game CASHFLOW, which teaches the game of money, here before only known by the rich.